our approach

Financial planning will mean different things to different people. But everybody benefits from a plan

It starts with a conversation

We believe with our help financial planning means you can make fully informed decisions about you, your future and your family.

We follow a ‘goals based’ approach which means identifying those ‘need to do’s’ as well as ‘want to do’s’ and setting a strategy to achieve them.

Ultimately, you need to have a plan that is robust enough to meet your demands but flexible enough to adapt when necessary.

ARIA Private Clients is part of the wider ARIA group, which has a breadth of client including banks, institutions,

pension funds and private clients.

One of the pillars of our proposition is bringing a sense of empowerment to you, a feeling on having control over money matters. Another cornerstone of our approach is to strive to deliver a highly personalised service to each of our clients.

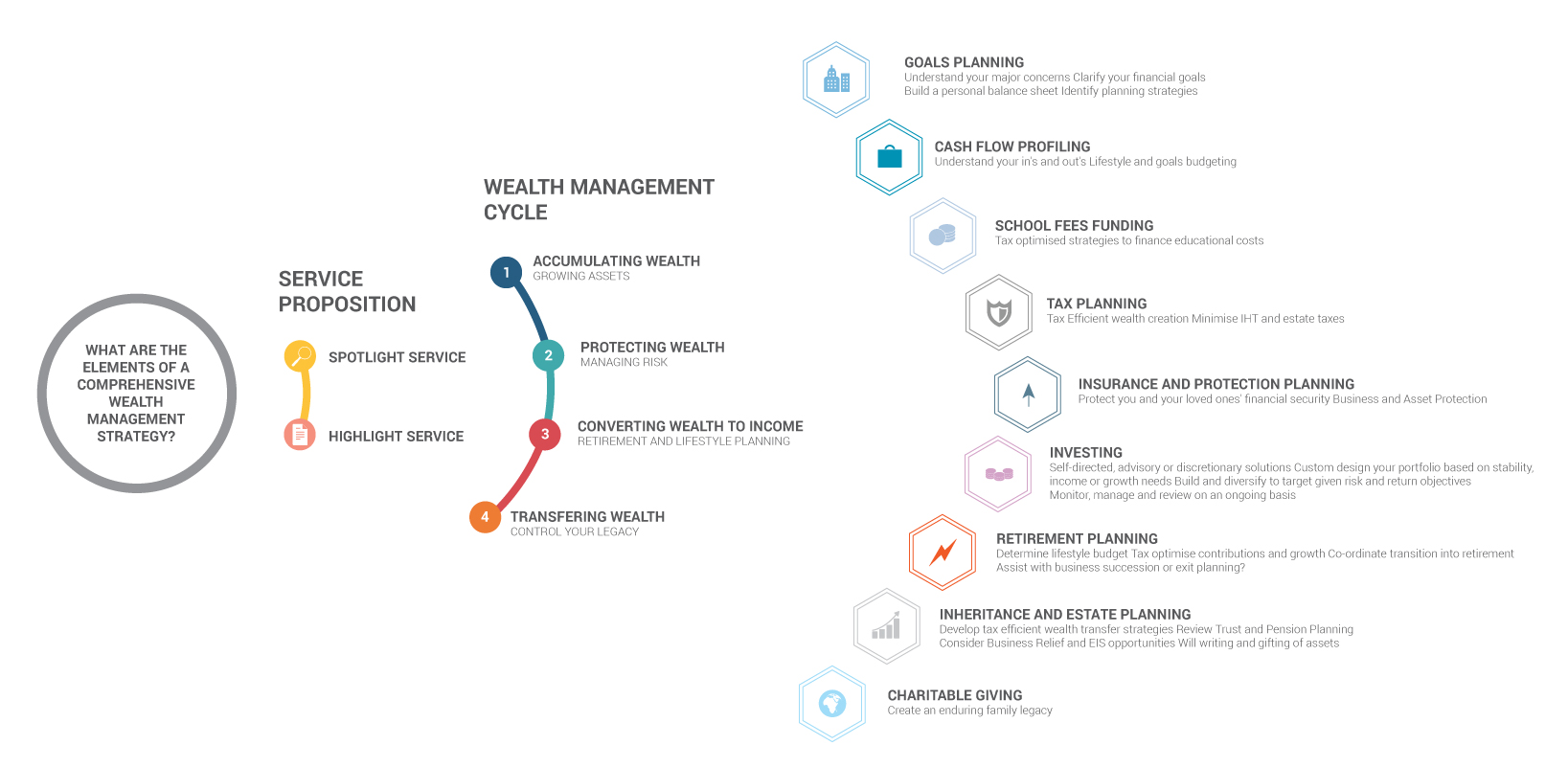

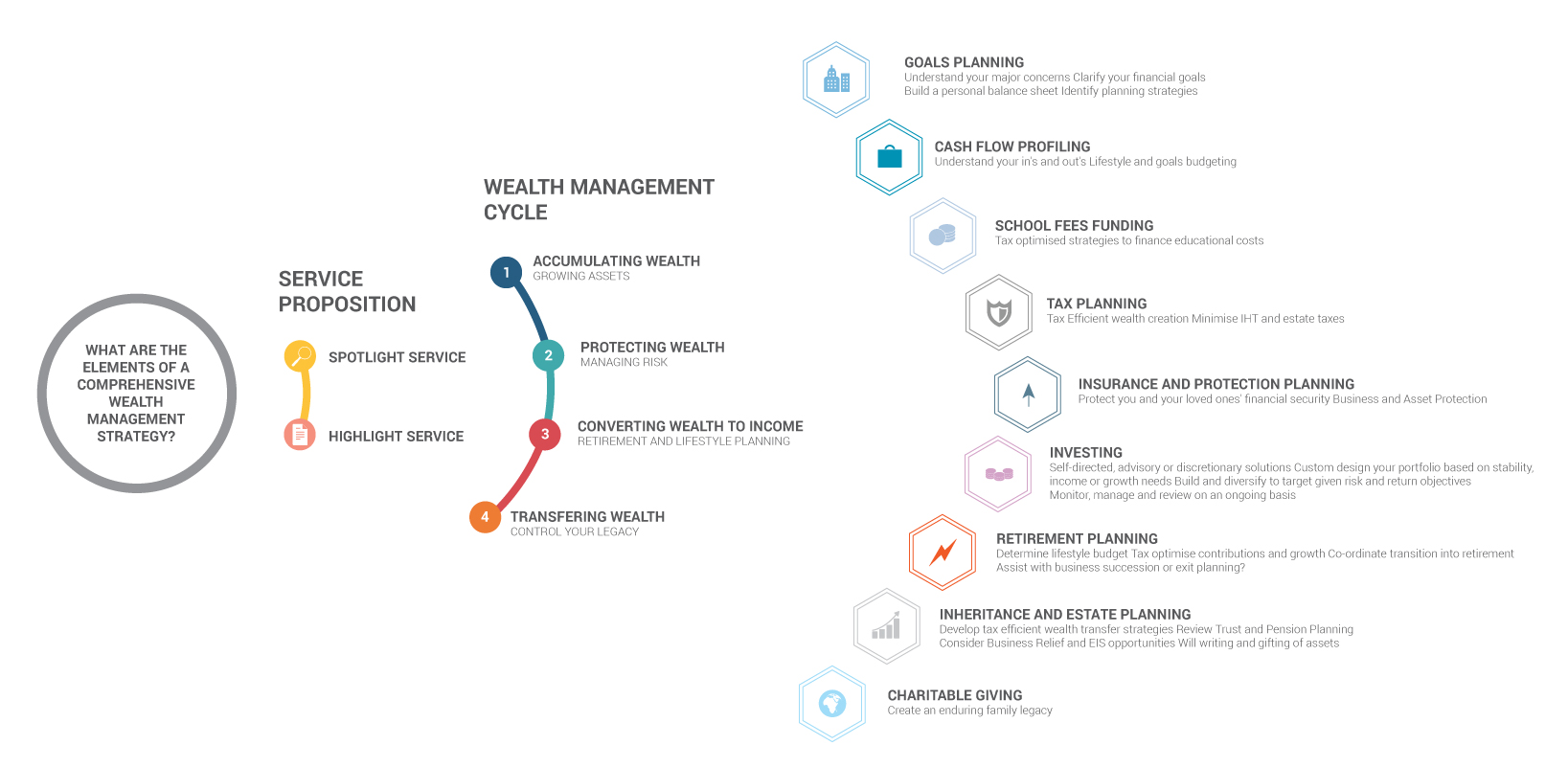

There are different approaches to offering wealth management services, but perhaps the most progressive, is referred to as ‘goals based planning’ Compared to a more traditional approach, goals based planning we believe brings greater clarity to your affairs, and moreover a greater sense of control. Moreover, it allows us to zero in on what’s really important to you, and identify strategies to reach those very individual goals you may have.

|

TRADITIONAL |

GOALS BASED |

|

|

Financial Factors Assets and Liabilities Single'Risk Attitude' | Financial and behavioural factors Client goals What matter's most |

|

Relative to Stock Market: Shorter term focus prevails | Monitoring progress towards established goals |

|

Single Risk tolerance for all investing 'buckets' | Risk capacity against each goal Seeks to calculate confidence levels of reaching a given goal Considers shortfall potential |

|

One overall portfolio | Asset classes or strategies for each individual goal |

Ultimately wealth management means: 'money on the move'.

As life transitions, your goals, both pressing needs and ideals, will progress with it. Goals based planning provides an ideal framework to put into place a life cycle wealth management process.

In your 30 to 40’s

In your 30 to 40’s

In your 40’s and 50’s

In your 40’s and 50’s

In your 50’s to 60’s

In your 50’s to 60’s

In your 60’s and 70’s

In your 60’s and 70’s

Mid 70’s and beyond

Mid 70’s and beyond

We call this ‘foundational planning’ i.e. getting the basics right. We expect that you’ll be focussed on:

Funding your lifestyle

Savings advice

Mortgage advice

Individual Savings Accounts

Learning how to manage your finances

Find out more about our ‘Spotlight’

service which could be an ideal fit.

But the ‘here and now’is more likely to be about:

Funding your lifestyle

Savings advice

Mortgage advice

Individual Savings Accounts

Learning how to manage your finances

Find out more about our ‘Spotlight’

service which could be an ideal fit.

At this point, there ‘here and now’ could well be:

Tie’ing the knot, or putting down roots

Aspiring to a larger property

Professional development and recognition

Perhaps with more disposal income to put to one side

At this point, there ‘here and now’ could well be:

Funding education (a professional qualification)

or school fees for children

Providing for loved ones (income protection, life assurance etc)

Pension planning – modifying and managing asset allocations

Maximising the tax efficiency of your investments

At this point, there ‘here and now’ could well be:

Teenage children – increasingly more depending

and ready to strike out their own

Reducing liabilities and paying down the mortgage

Aspirational spend may be growing –

more expensive hobbies or goods consumed

Potentially a dual income household,

with earnings capacity at its maximum

The ‘here and now’ is more likely to be about:

Educational costs – this time university fees

Optimising your tax liabilities through pension

contributions and ISA portfolios

Becoming more actuarial in managing assets and

forecasting cash flows and lifetime

budgeting exercises

At this point, there ‘here and now’ could well be:

Children have flown the coup and are no longer

‘financial dependents’, (save for a house deposit!)

Potential significant equity in property,

resizing or even relocation thoughts

Disposable income could be peaking

Pension and investment consolidation

Business planning, be it exit or succession thoughts

The ‘here and now’ could well mean:

Estate planning and pre-retirement advice

Lifestyle investing – considering market risks and

reducing exposure to riskier asset classes

Considering and maximising all allowances

Retirement options: flexi-working arrangements, early retirement

or a new career!

At this point, there ‘here and now’ could well be:

Taking on new hobbies, maintaining current interests

Property investment: a bolthole ‘away from home’

Transitioning from gainful employment

to a less ‘structured’ existence

The next generation

The here and now means a different set of priorities than may have gone before:

Inheritance tax planning

Gifting to family

Optimising your balance sheet to generate an income that

sustains your lifestyle

At this point, there ‘here and now’ could well be:

Living a healthy and comfortable life will

be high on most people’s agenda.

Personal health and provision for it

Lifestyle considerations including

current living / property arrangements

Gifting monies to family

There ‘here and now’ means making the most of every day, but more importantly having put into place the arrangements that ensure your legacy is what you would like it to be:

Placing assets into Trust

Giving assets away to charity

Ensuring wills are current

Inheritance Tax Planning

Ensuring asset allocations are still appropriate for their objectives

Care fees funding

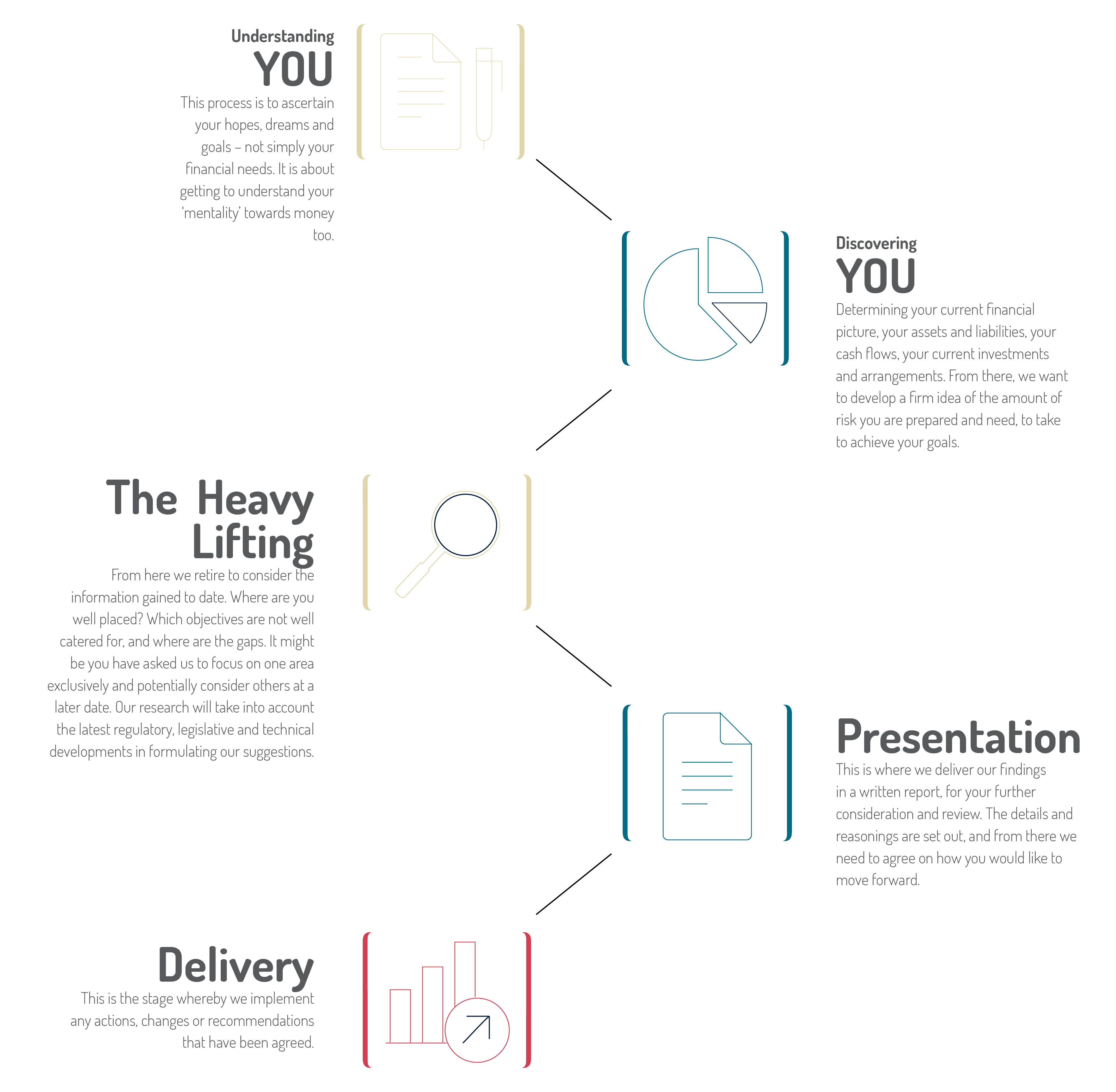

It will always begin with a ‘no obligation’ chat. A free initial meeting to get to know you. Only then can you set out your goals, needs and worries. From there, we’ll set out to identify the best means of addressing them, whilst having an open conversation about the costs involved in doing so.

Solving your problems.

Pensions and retirement planning

Inheritance tax planning

Tax efficient savings

Planning for long-term care

Wealth protection

Life events like divorce or bereavement

'Investment Portfolios

Individual Savings Accounts, (ISAs)

General Investments Accounts, (GIAs)

Investments bonds

Stakeholder pensions

Self-Invested Personal Pension (SIPPs)

QROPs

Life and term assurance

Income protection

Long-term care

Will writing

Estate Planning and administration

Trust creation and management

Annuities

Drawdown Options

Taking a lump sum

That’s down to you. It may be a short term engagement in relation to a specific task, or it could be an ongoing relationship borne out of wide ranging financial review. Alternatively, we may simply support your investing needs – be it professionally managing your assets, or providing an advisory or even online stock broking service.

Hopefully the plan that has been prepared is more than sufficient to deliver your goals. However, life being what it is, circumstances will change and at short notice, all of which will need careful consideration and likely adjustments to your financial planning needs along the way. Having an ongoing relationship means that together we will consistently monitor the progress and appropriateness of your arrangements – whilst being on hand to address any changes needed.

There is an abundance of general guidance and information available in the public domain. Be that the moneyadviceservice. org.uk or the Pensions Advisory Service, (pensionsadvisoryservice. org.uk), or information online from newspapers or advice sites. With today's readily available online resources, a lot clearly can be undertaken by oneself.

Technology too we feel should be used wherever possible to liberate, or to empower you. In that respect, we often feel that a mix and match proposition can work well for some, though for others a more self directed service is their preferred route. It may be you feel more comfortable with having a professional adviser consider and set out a personalised approach specific to your circumstances and then take on the responsibility for managing investments, removing another daily distraction. We're very deliberate in offering three different service levels, so should we engage, you will feel that you have just the right level of support.

We would expect to hold a no obligation engagement in the first instance, where there are no fees levied allowing you to feel comfortable to speak openly about your goals without fear of a pending bill. Due to our Spotlight service, we can accommodate those with more simple needs, with readily digestible charging structure that means your investments or needs are well catered for in a very cost effective manner.

The charges typically include an initial fee for providing a well researched and highly relevant set of solutions or arrangements for you in our opinion, to best meet your goals. Those charges mean that we can keep a well resourced team at hand, to keep up to date with the latest regulatory and financial market developments, so that we can keep you well placed at all times.

We have sought to offer different service levels for different price points. That being the case, regardless of the complexity of your affairs, we believe we can offer a service that means the value of recommendations, both in terms of the investment returns generated, and the tax that you may save, all contribute towards a very affordable and value for money proposition.

It is not the current value of your asset base that matters – more ensuring it’s longevity to continue to support you throughout your years. Generating sustainable income levels can be difficult in today’s low interest rate environment and therefore having access to specialist research and investment management resource can make all the difference. Moreover, the impact of inflation can be a major threat to the value of income streams and their purchasing power going forwards. As life expectancy generally trends up, considerations such as possible care needs and estate planning will inevitably become planning requirements well after you may have begun your retirement.

We offer both and it will depend on your choice of service level.

Our Highlight service is one whereby we will act as an intermediary between you and a whole market place of products and services. Depending on your level of wealth, we may employ a centralised investment proposition. This is where we have conducted extensive due diligence on a range of providers, including fund managers globally and drawn up a short list of those who provide either best in class or a differentiated proposition, so we can cater to a wide range of preferences and needs. Within the global selection of fund managers, we also offer our own funds, particularly where we feel there isn't a similar proposition available elsewhere.

Spotlight is our focussed advice service and it is limited to certain investment options that we feel are suitable for you, given the information we have to hand. In that respect, it reflects more of a ‘panel’ based approach. In providing solutions to clients we may recommend use of funds managed by us too. We are also likely to implement many of the investment solutions we offer, on our own bespoke wealth management platform. This technology is built on top of SEI Global Investments, one of the world’s largest custodians. To that extent, we do not hold your monies, but are regulated to arrange for custody with third parties

Yes we can. In fact, retirement planning is one of our areas of expertise, and a very common reason to seek out financial advice. However, we do not advise on Defined Benefit pension plans.

Highlight is our comprehensive wealth management proposition which includes both financial planning and investment advice. It often means completing a ‘holistic review’ of your circumstances, before highlighting certain aspects of your financial arrangements for you to consider further. It usually requires an ongoing engagement and within investments north of 200,000 GBP or currency equivalent. We would expect regular contact both through email, telephone and face to face meetings.

You’re always welcome.